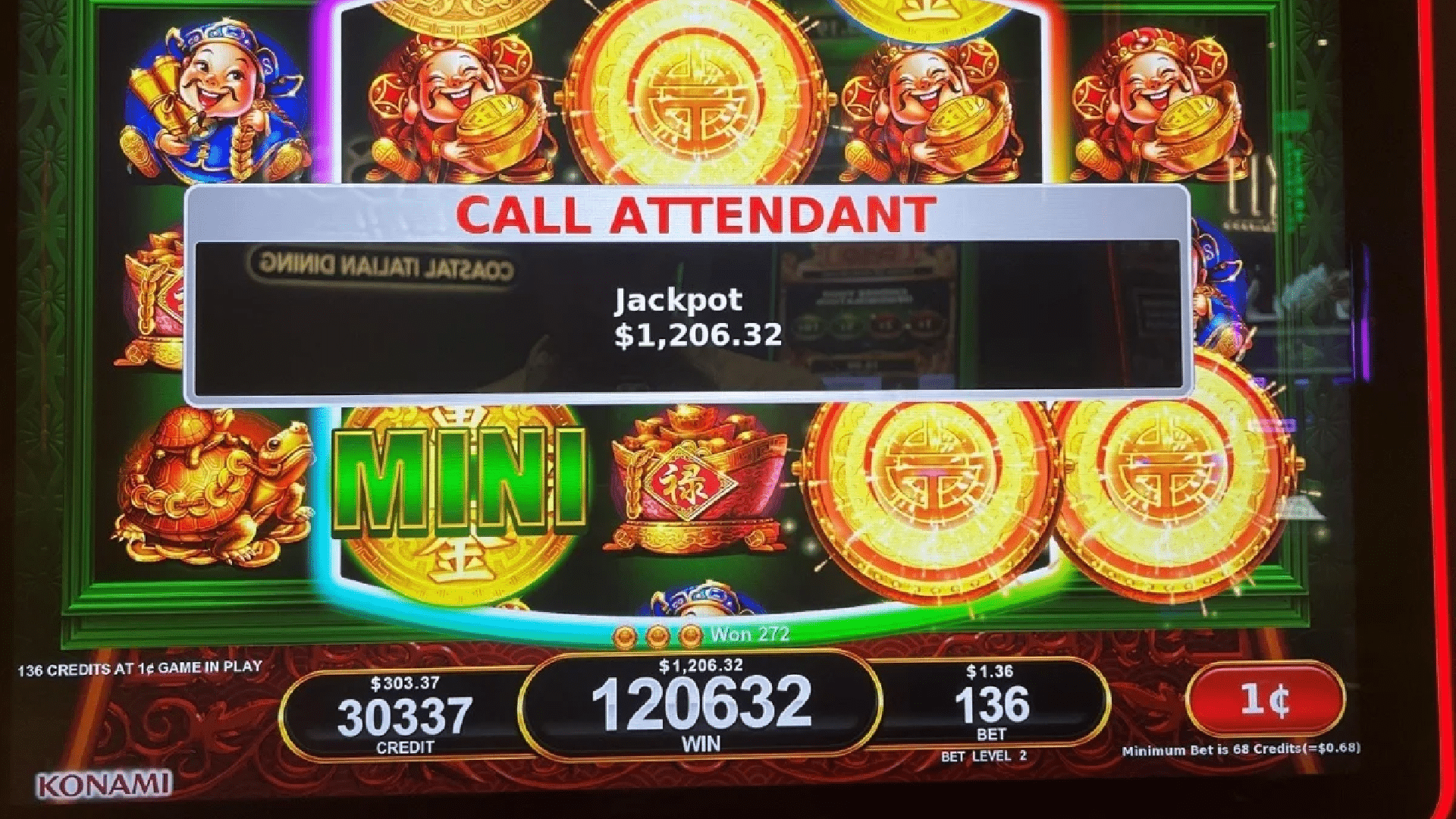

Since SBC Americas reportedly revealed a little-known tax provision hidden in the "One Big Beautiful Bill Act" (OBBBA) that suggested the slot tax reporting threshold would be raised from $1,200 to $2,000 effective January 1, 2026, the gaming industry, along with its numerous commentators and online influencers, has been in a frenzy.

Tom Nightingale of SBC Americas verified with the offices of Nevada Congresswoman Dina Titus and the American Gaming Association that Section 70433 of OBBBA increased the minimum reporting threshold for both W-2G forms and 1099-MISC filers. By removing $600 and adding $2,000, Section 70433 creates a "increase in threshold for requiring information reporting with respect to certain payees."

This week, Casino.org verified its stance with the AGA, which stated that the "slot threshold is tied to that section of the code" and that the section alters "any reporting under section 6041 of the Internal Revenue Code."

The internet conversation seemed unclear. According to several tax experts and accountants, OBBBA did not change the Tax Code's Section 3402, which regulates W-2G.

Threshold for Slot Tax Clarity

Sophia Yan received a BA in public policy with honors from the University of Chicago and a JD from the University of Pennsylvania Law School. Prior to joining NYU Law's Tax Law Center, she worked as a tax law clerk for the Senate Finance Committee.

After reviewing the relevant OBBBA tax provision, the Tax Law Center's attorney advisor in Washington, D.C., had the following observations:

"I agree with the reading that the slot tax reporting threshold would essentially be raised from its current $1,200 threshold to $2,000 by OBBBA. Form W-2G implements the reporting requirements in the regulations at 26 CFR 1.6041-10, which define reportable gambling winnings at varying thresholds above $600 depending on the type of game. But these regulations implement Section 6041(a) of the Code, which requires reporting of ‘gains, profits, and income’ of $600 or more of the regulations,” Yan said.

According to Yan, "it is arguable that the prior existing slot tax reporting threshold regulations were not in accordance with Section 6041(a) even pre-OBBBA," even though Section 6041(a) does not contain any statutory exclusions or alterations based on game kinds.

Yan went on:

"In any case, the change in the Section 6041(a) as a result of OBBBA appears to re-establish a floor of $2,000 for reporting of all types. A more recent statutory change takes precedence over regulations.”

Yan concurred with an accountant from Casino.org that was previously mentioned that the information on Form W-2G is unaffected by Section 6041(a). But, she adds, "The form's instructions and the deadline for submitting it to the IRS should be updated to reflect the change."

"Bring a public interest perspective and strong legal expertise to consequential tax policy decisions" is the stated goal of NYU Law's Tax Law Center. One aspect of the Center's activity is providing commentary on the specifics of tax laws.

In addition to raising the slot tax threshold to $2,000 in 2026, Section 70433 states that the barrier will rise in accordance with inflation starting in 2027. Each calendar year's cost-of-living adjustment, which is rounded to the nearest multiple of $100, will be multiplied by the current amount to determine the increase.

Long Overdue

The $1,200 trigger for slot tax reporting has been in place since 1977, and both casinos and players want it raised. The SLOT Act, a federal measure sponsored by Titus, would raise the reporting requirement to $5,000, which is still less than what $1,200 in 1977 is worth now (around $6,600).

Handpays are far more common now than they were nearly fifty years ago, and every time a player wins more than $1,200, the machine is compelled to go offline, disrupting their enjoyment and producing onerous paperwork.

Although $2,000 is a good place to start, Titus, her colleagues in the Nevada congressional delegation, and the AGA will keep pushing for a larger slot tax reporting level in Washington, DC.